Ever wondered who keeps India's banks, stock markets, and insurance companies in check? Dive into this comprehensive guide to understand the distinct roles of the RBI, SEBI, and IRDAI – India's financial guardians – ensuring your money is safe and the system runs smoothly. Get clarity on who regulates what and why it matters for every Indian citizen!

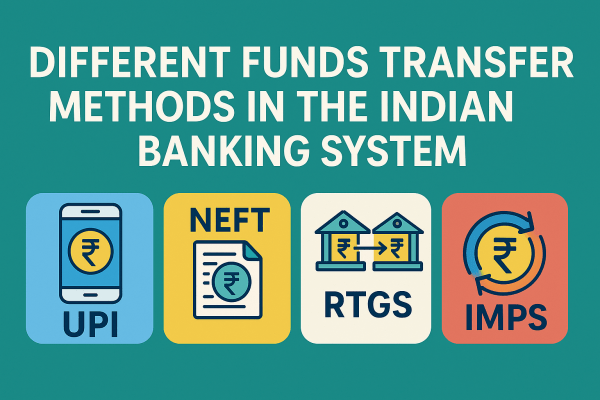

NEFT vs RTGS vs UPI: Which Payment Mode Is Right for You?

From NEFT and RTGS to UPI and IMPS, India’s banking system offers a variety of fund transfer methods suited for every need—from ₹10 mobile payments to ₹10 lakh real estate deals. Whether you’re a student, entrepreneur, or homemaker, choosing the right mode can save you time, money, and effort. This blog explains all major Indian fund transfer systems with examples, use cases, and tips for safe digital banking.

Understanding Repo Rate

Have you ever wondered how the Reserve Bank of India (RBI) controls inflation or manages money in the economy? One important tool it uses is called the Repo Rate. Don’t worry if it sounds complicated – in this article, we’ll break it down into simple words so anyone can understand!

Understanding Cash Reserve Ratio (CRR)

Imagine you run a lemonade stall and keep some money aside before spending on lemons and sugar — that’s what banks do with the Cash Reserve Ratio (CRR). It’s a portion of cash banks must keep with the RBI, not for lending. A lower CRR means banks can lend more, boosting spending and growth, while a higher CRR restricts money flow to control inflation.