09th June 2025, Gaurav Kumar Singh

Introduction: A Nation on the Digital Fast Track

Over the past decade, India has rapidly embraced digital payments. From street vendors to high-end retailers, digital transactions have become a common sight. At the heart of this transformation is the Unified Payments Interface, popularly known as UPI. It has revolutionised how Indians transfer money, pay for services, and shop online or offline.

But UPI isn’t the only player in the game. A deeper look reveals that while UPI dominates day-to-day payments, net banking, credit cards, and EMIs continue to play critical roles, especially in specific sectors like education and automobiles.

UPI: The Preferred Choice for Everyday Transactions

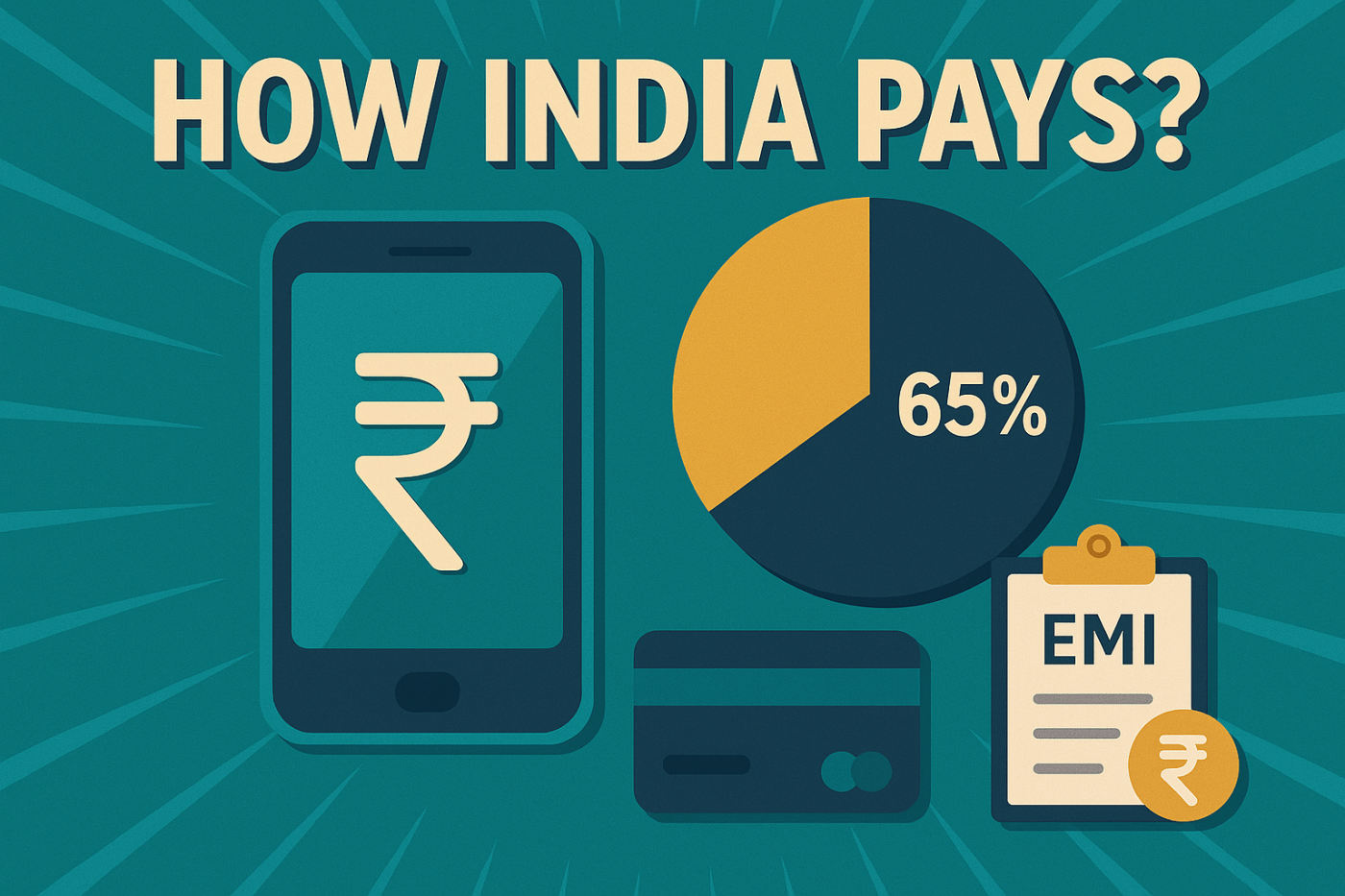

UPI has become the undisputed leader in India’s digital payment ecosystem. According to data shared by Phi Commerce, UPI now makes up 65% of total digital transactions in the country. That’s more than any other payment mode.

Why is UPI so popular?

It’s free, instant, secure, and incredibly easy to use. All one needs is a mobile phone, a bank account, and an internet connection. With the support of government initiatives and increasing smartphone penetration, UPI has become a household name—even in small towns and villages.

UPI is especially preferred in sectors like retail, food and beverages, e-commerce, healthcare, and government utility payments.

In fact, 75% of digital payments in government and utility services happen through UPI or mobile wallets.

Not One Size Fits All: Net Banking and Credit Cards Still Have Their Place

While UPI dominates the daily transactions scene, it doesn’t suit every need. Some sectors still rely on more traditional digital payment methods. For instance, education-related payments such as school or college fees are often made using net banking. This is because such transactions are typically high in value, require bank records, and are often done through formal portals.

Similarly, in the auto and automobile accessories sector, credit cards are preferred. These purchases often involve higher amounts, and credit cards offer the flexibility of easy installments, cashback offers, and EMI conversions.

In these cases, security, documentation, and the ability to defer payments make net banking and credit cards more practical choices than UPI.

EMIs: The New Normal for Big Ticket Expenses

Another growing trend in 2025 is the use of EMIs—Equated Monthly Installments—for high-value purchases. One in every five transactions in the retail and government utility sectors is now happening through EMI.

Consumers are increasingly comfortable spreading their payments over several months. This is particularly visible in sectors like healthcare, automobiles, and even education. Whether it’s a medical procedure, a new smartphone, or school admission fees, EMIs offer financial breathing space for many households.

According to the same Phi Commerce study, EMI-based payments account for around 20% of the transaction volume in both retail and government services. Even in auto and healthcare sectors, the EMI share is about 15%, showing a clear trend toward installment-based spending.

Seasonal Trends: When India Pays the Most

Digital payments in India also show strong seasonal patterns depending on the sector. In education, payment activity spikes during March, April, and July—these months align with school and college admission cycles.

In healthcare, transactions go up towards the end of the year, likely due to insurance renewals and annual health check-ups.

Retail sees its peak during December when holiday shopping and year-end discounts drive a surge in consumer spending.

E-commerce payments reach their high during the festive season—especially around Diwali—when people take advantage of sales and offers.

These patterns show how financial decisions are closely tied to life events, cultural traditions, and seasonal changes.

Conclusion: India’s Payment Habits Are Evolving—And Fast

India’s journey toward becoming a cashless economy is well underway. UPI has taken the lead by offering a fast, simple, and reliable payment method for everyday needs. However, the landscape is far from one-dimensional.

Net banking, credit cards, and EMIs continue to play vital roles in specific sectors, especially for high-value or formal transactions. The growing use of EMIs reflects an important shift in consumer behaviour—one where affordability and convenience matter just as much as speed.

Understanding how India pays isn’t just about numbers and percentages. It’s a story of changing habits, rising aspirations, and a digital revolution that has reached every corner of the country.

As technology continues to advance and financial literacy spreads, India’s payment ecosystem will only get more inclusive, adaptive, and consumer-friendly in the years to come.

If you found this article valuable, please don’t forget to Like and Subscribe to my blog for more expert insights and updates.

Leave a comment