06th May 2025, Gaurav Kumar Singh

In the fall of 2016, a quiet panic swept through the boardrooms of India’s telecom giants. The reason? A storm was coming — and its name was Reliance Jio.

With a launch that would go down in corporate history, Jio, backed by Mukesh Ambani’s Reliance Industries, didn’t just enter the market — it blew it wide open. Free voice calls. Free 4G data. Free roaming. For months. It was a tsunami, and many wondered: Could anyone survive this?

One company did more than survive. It adapted. It fought. And it rose again. This is the story of Bharti Airtel — the telecom veteran that stared down the Jio juggernaut and lived to tell the tale.

The Day the Game Changed

September 5, 2016. Jio officially launched its services to the public. The offers were unbelievable. For a time, data was virtually free, and millions of Indians who had never used the internet suddenly found themselves streaming, downloading, and video calling at lightning speed — without paying a rupee.

Airtel, with decades of legacy and the title of India’s largest telecom operator at the time, watched its market begin to erode. Jio’s customer base exploded. In just 170 days, it crossed 100 million subscribers — a world record. Prices across the industry plummeted. Smaller players like Aircel and RCom shut down. Vodafone and Idea, former rivals, merged out of desperation.

Airtel faced the biggest crisis in its history. But its story was just beginning.

The Pivot: From Panic to Strategy

Sunil Bharti Mittal, the founder of Airtel, knew this wasn’t just a price war. This was a technology war, a perception war, and a patience war. So, Airtel stopped playing defense and quietly started to transform itself — from a traditional telecom operator to a future-ready, digital-first tech company.

Behind the scenes, Project Leap was underway — a massive ₹60,000 crore ($8 billion) investment to upgrade Airtel’s network. Towers were replaced, new 4G spectrums were acquired, and the company aggressively expanded its high-speed network to reach deep into rural India.

Customers started noticing. Speeds improved. Call drops reduced. And while Jio attracted price-sensitive users, Airtel doubled down on quality and reliability.

The Comeback Through Customer Centricity

One of Airtel’s cleverest moves came in 2021, with the introduction of Airtel Black — a bundled service that offered mobile, broadband, and DTH under one bill, with a personal relationship manager and priority support.

This wasn’t just a product. It was a statement: Airtel was listening, and it was building for the premium Indian household, not just the masses.

They focused on high-value users. Where Jio chased volume, Airtel chased loyalty. It wasn’t glamorous, but it was effective.

By 2022, Airtel had the highest Average Revenue Per User (ARPU) in the industry. That’s a crucial number in telecom — it means each customer is more profitable. Airtel wasn’t winning by numbers; it was winning by value.

Digital Leap: Competing on Content and Convenience

Remember the days when your telecom provider was just about calls and texts? Airtel reimagined that.

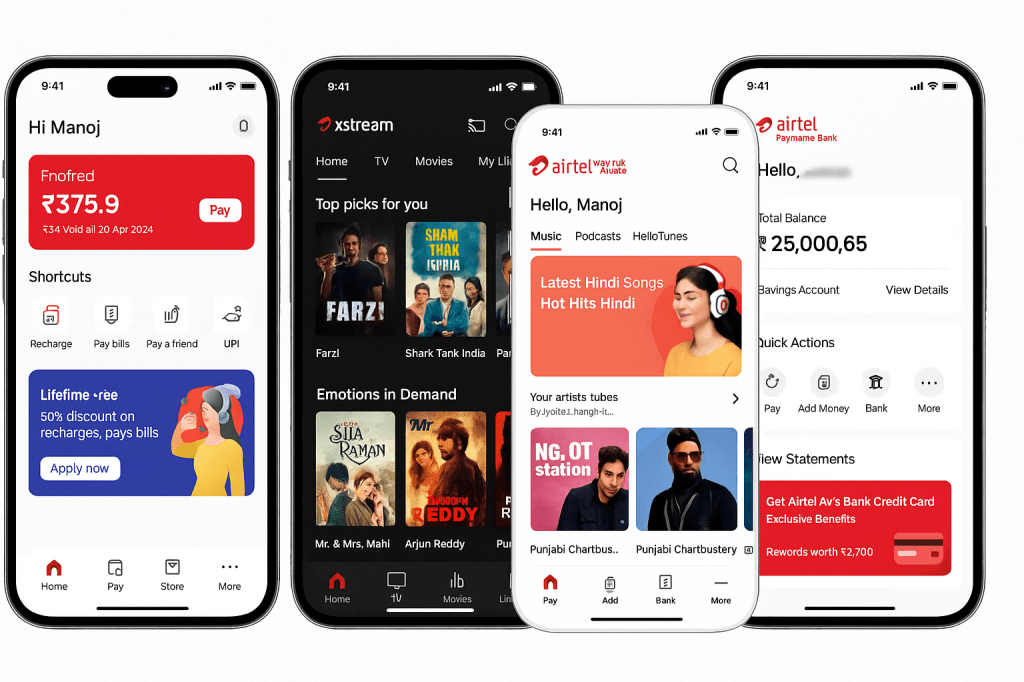

Through apps like Wynk Music, Airtel Xstream, and Thanks, it built a complete digital ecosystem. Music, movies, payments, OTT subscriptions — all in one place.

Jio had the scale, but Airtel had something more subtle: a relationship with its users. Their “Open Network” initiative allowed users to check tower locations and signal strength in real-time — a move that created transparency in a notoriously opaque industry.

Customers didn’t just stay — they began coming back.

War Chest: Smart Funding, Global Allies

As rivals drowned in debt, Airtel played its cards carefully. It raised capital, yes — but it did so strategically.

In 2020, Google invested $1 billion into Airtel, signaling global confidence in its vision. In another major move, Amazon was reported to be in early talks with Airtel for cloud partnerships, while Airtel expanded its presence in enterprise services and cybersecurity through Airtel Business.

This wasn’t just survival. It was evolution.

A Leap Into the Future: 5G and Beyond

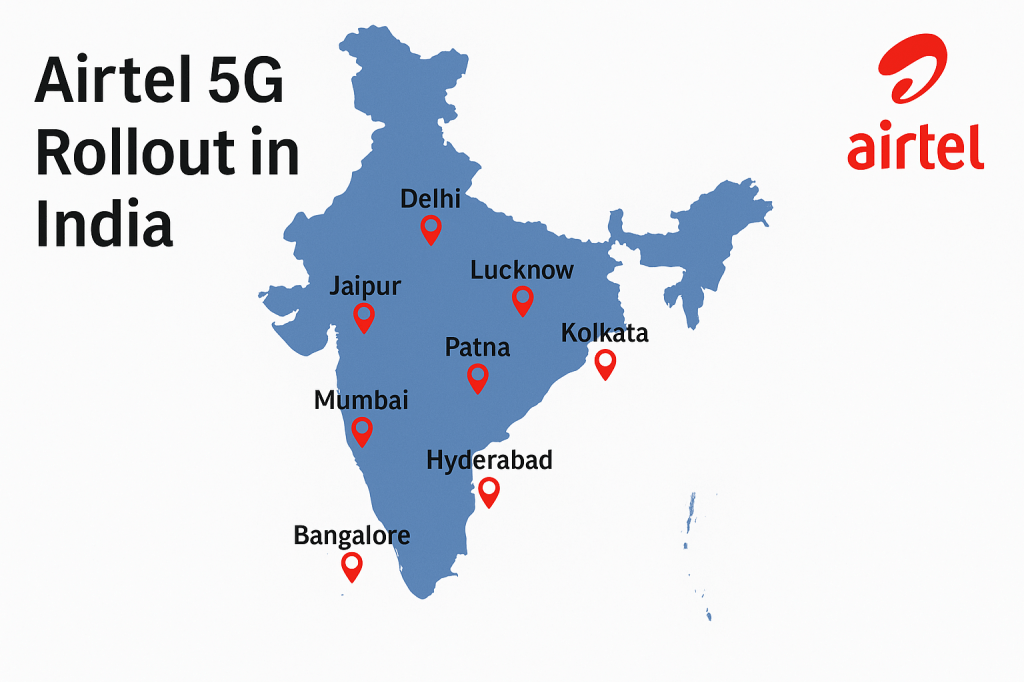

When the 5G spectrum auctions took place in 2022, Airtel didn’t wait. It launched Airtel 5G Plus within months, rolling out the service across major cities faster than expected.

In contrast to Jio’s standalone 5G approach, Airtel used a non-standalone network architecture — a clever move that allowed faster deployment using existing 4G infrastructure.

By mid-2024, Airtel was covering thousands of cities and towns with 5G — serving not just individuals but also partnering with industries, hospitals, and smart cities.

The Numbers Speak

Despite Jio’s massive market share:

* Airtel’s ARPU crossed ₹200, higher than Jio’s.

* Airtel had over 500 million users globally, with strong growth in Africa and South Asia.

* Its stock price tripled from 2020 to 2024.

* Revenue from non-mobile services (like cloud, IoT, and broadband) grew by over 30% YoY.

From a financial, technological, and strategic lens — Airtel had found its footing.

Conclusion: The Fighter Who Learned to Fly

The battle between Airtel and Jio wasn’t just about telecom plans or network speed. It was a battle of mindsets.

Jio entered the arena like a tech startup — fast, aggressive, and disruptive. Airtel responded like a seasoned warrior — patient, strategic, and agile.

While many doubted Airtel’s ability to survive, it didn’t just weather the storm — it rewrote its playbook, proved its mettle, and emerged stronger, leaner, and more focused than ever.

In the war for India’s digital future, Airtel’s story isn’t just about survival — it’s a masterclass in resilience, reinvention, and relevance.

If you found this article valuable, please don’t forget to Like and Subscribe to my blog for more expert insights and updates.

Leave a comment