25th April 2025, Gaurav Kumar Singh

Gold holds a special place in the hearts and homes of millions of Indians. Whether it’s a wedding, a festival, or a long-term investment plan, gold has always been the metal of choice. But in recent years, many Indians have been asking a common question:

Why is gold so expensive in India?

This blog breaks down the answer in simple terms, helping you understand what makes gold prices rise, why India pays more than many other countries, and what it means for your personal finance decisions.

1. Gold and India: A Deep Emotional & Cultural Connection

Before diving into economics, let’s understand the emotional value of gold in India:

• Weddings & Gifts: In Indian weddings, gold isn’t just jewelry—it’s tradition. It’s considered a form of wealth passed across generations.

• Festivals: Akshaya Tritiya, Dhanteras, and Diwali often witness huge gold purchases.

• Symbol of Security: For many Indian households, gold is seen as the ultimate backup plan in tough times.

This strong cultural demand keeps the market for gold in India always active—no matter the price.

2. India Doesn’t Produce Gold, It Imports It

Here’s a key reason gold is expensive in India:

India imports over 90% of its gold.

We don’t mine enough gold to meet domestic demand.

So, when we import gold, we have to pay:

• International gold price (which fluctuates daily)

• Import duties and taxes

• Transportation and insurance costs

All of these costs get added to the final price that you pay at a jewelry shop or bank.

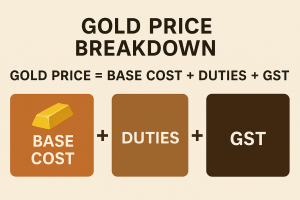

3. High Import Duty & Taxes on Gold

As of now, the total import duty on gold is around 15% (including customs duty, Agriculture Infrastructure and Development Cess, and GST).

Let’s break this down:

• Basic Customs Duty: 12.5%

• AIDC (Cess): 2.5%

• GST: 3% (on the total price)

This means gold becomes significantly more expensive in India compared to international rates.

Example:

If the international gold price is ₹50,000 per 10 grams, after taxes and duties, the price in India could easily reach ₹58,000 or more.

4. Rupee vs Dollar: Currency Matters

Gold is traded globally in U.S. Dollars (USD).

If the Indian Rupee weakens against the Dollar, gold becomes more expensive in India—even if global prices stay the same.

For example:

If $1 = ₹70 last year and becomes $1 = ₹80 this year, you’ll pay more Rupees for the same amount of gold.

5. Inflation and Economic Uncertainty

Gold is called a “hedge against inflation.”

Whenever inflation rises or the economy becomes unstable:

• Investors rush to buy gold.

• Demand increases, and so does the price.

Events like geopolitical tensions, stock market crashes, or pandemics (like COVID-19) often push gold prices higher.

6. Jewelry-Making Charges & Wastage Costs

When you buy gold jewelry, you also pay:

• Making charges (typically 8–25% of gold price)

• Wastage charges (a small % for design complexity)

These are extra costs that make gold jewelry even more expensive than just buying pure gold bars or coins.

7. High Domestic Demand All Year Round

India is one of the largest consumers of gold in the world.

According to the World Gold Council:

India consumes 700–900 tonnes of gold every year.

This continuous and predictable demand keeps prices stable or rising, especially during:

• Wedding seasons

• Festive months (October to March)

Unlike many countries where gold is bought mostly for investment, Indians buy gold for emotional and cultural reasons, which makes demand more resilient to price increases.

8. Speculation and Global Trends

Gold is also influenced by:

• Central bank gold buying

• Interest rate decisions by the U.S. Fed

• Global political tensions (like war or trade disruptions)

India can’t control these global events—but they directly impact how much gold costs here.

9. Digital Gold & ETF Costs

Even if you’re not buying physical gold, prices for:

• Digital Gold

• Gold ETFs

• Sovereign Gold Bonds

are still based on market gold rates. You save on making charges but not on import-based costs or taxes embedded in the market price.

10. Conclusion: Should You Still Buy Gold?

Gold may be expensive, but it’s not just about price.

Here’s what you should consider:

• As Jewelry: Buy smart—choose BIS hallmarked gold and negotiate making charges.

• As Investment: Explore Sovereign Gold Bonds (SGBs)—they offer interest and are tax-free after 8 years.

• As Safety Net: Gold still holds value during crises and market volatility.

Final Thoughts

Gold in India is expensive because of a mix of import dependency, taxes, currency fluctuation, and high cultural demand.

But it remains a trusted store of value.

If you understand why it’s expensive, you can make smarter buying decisions, whether for tradition or investment.

If you found this article valuable, please don’t forget to Like and Subscribe to my blog for more expert insights and updates.

Leave a comment