24th April 2025, Gaurav Kumar Singh

Car insurance is not just a legal requirement, it’s a financial safety net for you and your vehicle. While a standard policy covers basics like third-party damage, theft, and vehicle repairs, you can boost your protection by choosing add-on covers. These optional extras offer more comprehensive coverage and peace of mind, especially during uncertain times like floods, accidents, or mechanical failures.

What Are Add-On Covers?

Add-on covers (also called riders or endorsements) are additional protection options you can purchase along with your regular car insurance policy. They’re designed to give you more personalized and extensive coverage depending on your needs.

These covers come at an extra cost but can save you a lot of money and trouble in the long run.

Popular Car Insurance Add-Ons

Here are some of the most useful add-ons that you can choose to strengthen your insurance plan:

1. Zero Depreciation Cover

Normally, insurance companies deduct depreciation on car parts when you make a claim. But with zero depreciation, you get the full claim amount without any deductions. This cover is especially helpful for new cars and high-end vehicles.

2. Engine Protection Cover

Your car’s engine is expensive to repair. This add-on protects it from damage due to water ingress, oil leaks, or mechanical failures that are not covered under a basic policy. Highly recommended for cars in flood-prone areas or luxury vehicles.

3. Return to Invoice Cover

In case of total loss or theft, this cover ensures you get the original invoice value of your car, not just the depreciated value. It even includes the cost of accessories and road tax.

4. NCB (No Claim Bonus) Protection

Normally, if you make a claim, you lose your No Claim Bonus. With this cover, you can retain your NCB even if you make a claim during the policy year. It helps reduce future premiums.

5. 24×7 Roadside Assistance

If your car breaks down in the middle of the road, this cover offers help like towing, tire changes, fuel delivery, and more. It’s like having a personal mechanic on call — anytime, anywhere.

6. Key Replacement Cover

Losing or damaging your car keys can be frustrating and expensive. This cover compensates for the cost of replacing your car keys and even the lock, in case of theft or damage.

7. Daily Allowance Cover

If your car is in the garage after an accident, this cover provides money to hire a cab for daily travel. The amount may range from ₹100 to ₹500 per day depending on your policy.

8. Personal Accident Cover

Provides financial protection for the driver and passengers in case of injury, permanent disability, or death due to an accident.

9. Consumables Cover

This covers the cost of nuts, bolts, engine oil, washers, etc., which are not usually included in a regular policy but are necessary during repairs after an accident.

10. Loss of Personal Belongings

If your belongings (like a phone, laptop, or documents) are stolen from the car or damaged in an accident, this cover offers compensation up to ₹50,000.

Why Add-Ons Matter

Not everyone needs every add-on. But depending on your driving habits, car type, and location (like flood-prone areas), some add-ons can be very valuable.

They give you extra protection during unexpected events and help reduce out-of-pocket expenses significantly. It’s better to pay a little extra now than face heavy losses later.

Final Thoughts

A standard car insurance policy gives you the minimum protection required by law. But add-ons help you tailor your insurance plan to your real-world needs.

Before buying add-ons:

- Check which ones are most relevant to you.

- Compare what different insurers offer.

- Understand exclusions and claim conditions.

With the right mix of coverage and add-ons, you’ll be prepared for almost anything the road throws your way.

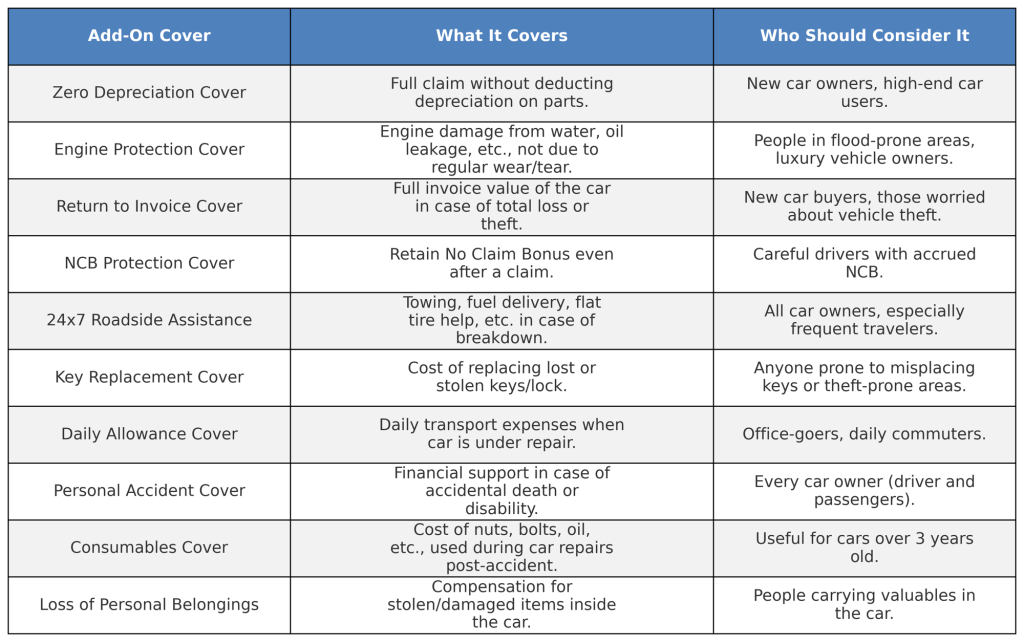

Quick Summary: Auto Insurance Add-Ons

Here’s a simple table to help you decide which add-ons are right for you:

If you found this article valuable, please don’t forget to Like and Subscribe to my blog for more expert insights and updates.

Leave a comment